Invest Ontario is supporting Linamar Corporation’s more than $1 billion investment in Ontario to develop cutting-edge powertrain components and green automotive technologies, creating more than 2,300 jobs.

Automotive

A North American leader in automotive manufacturing

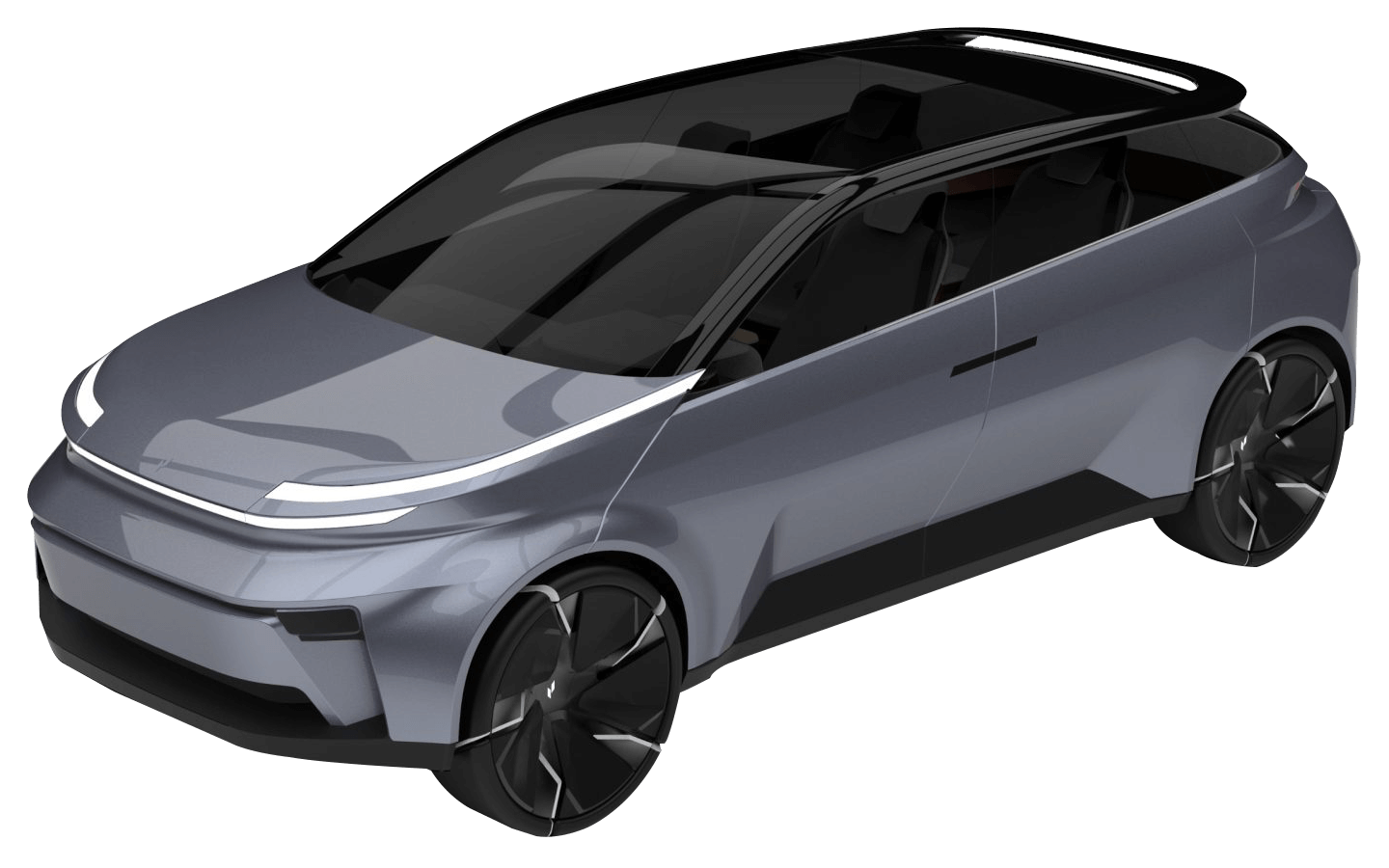

Project Arrow, the first, all-Canadian, zero-emissions connected vehicle, designed and built in Ontario

With a robust supply chain, a wealth of critical minerals and a talent pool of experts, Ontario's automotive manufacturing legacy spans over 100 years.

Ontario is leading the way in the EV transition, leveraging its leadership in technology development and AI. Home to five major automotive assemblers: Ford, General Motors, Honda, Stellantis and Toyota. In 2023, Volkswagen Group-owned battery company PowerCo chose Ontario to build its first battery cell factory in North America.

Build the cars of the future here, in Ontario.

A measurable difference

#2

auto producer in North America after Michigan in 2024

~1.3

million vehicles built in 2024

~90,000

workers directly employed in Ontario’s auto sector

36

auto-focused programs at Ontario universities and colleges

400+

companies work in connected and autonomous development and smart mobility

Unlock your automotive potential in Ontario

From steel to steering: Ontario’s unparallelled auto ecosystem

Build an entire vehicle in Ontario using our end-to-end automotive supply chain.

From raw materials to parts and assembly for Internal Combustion Engine (ICE) vehicles, Ontario’s automotive corridor is reliable and talent-rich.

In January 2023, the first, all-Canadian, zero-emissions connected vehicle, designed and built in Ontario, was unveiled at the Consumer Electronics Show (CES). Project Arrow leverages Ontario’s end-to-end automotive supply chain and demonstrates the province’s world-class automotive innovation on a global stage.

Ontario is home to rich deposits of nickel, lithium, platinum, cobalt and other crucial raw materials, making it one of the best places in the world to manufacture cars and car parts.

Ontario’s mining industry has generated more than $13 billion in mineral production and in March 2022, the Ontario Government released a Critical Minerals Strategy, "Unlocking potential to drive economic recovery and prosperity" to further enable production and exploration

The backbone of Ontario’s automotive industry ecosystem is its people. The world’s best and brightest call Ontario home, driving advancements across the automotive cluster.

Ontario has 12 leading universities and 24 colleges with auto-focused programs, boasting more than 86,000 STEM graduates per year.

ONTARIO: THE FUTURE OF AUTOMOTIVE STARTS HERE

Tech Expertise

Innovation in EVs, PHEVs, connected cars and autonomous vehicles happens every day in Ontario.

As the second most concentrated IT cluster in North America, after Silicon Valley, Ontario’s innovations in EVs, PHEVs, connected cars and autonomous vehicles happen every day in Ontario.

3rd

North America’s third-largest ICT region by employment

448,000+

ICT workers

Global Production

In 2024, Ontario was the number two automotive producer in the world next to Michigan building ~1.3 million vehicles.

With 14 border crossings into the US and 15 trade agreements, Ontario manufacturers supply cars all over the world.

Build from a foundation of success.

Ontario is home to five major global automotive assemblers.

In addition to these OEMs investing billions of dollars to produce EVs and PHEVs, Ontario has attracted billions of dollars in battery cell manufacturing from PowerCo (Volkswagen) and NextStar (LGES-Stellantis), as well as CAM production by Umicore.

In the past five years, Ontario has attracted over $46 billion in new investments in vehicle manufacturing and the electric vehicle battery supply chain.

-

Other Investments

-

-

-

-

-

-

-

-

-

-

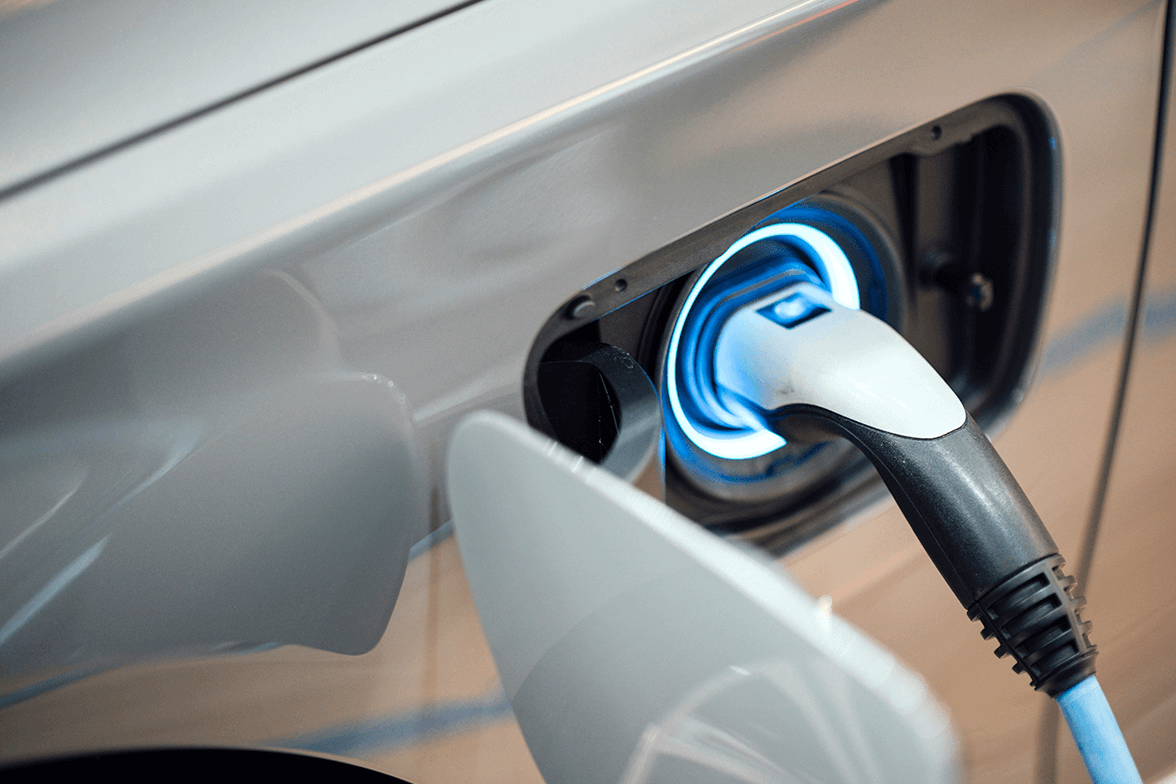

A new wave of vehicles

Ontario has seen massive investments by industry leaders in the EV sector.

Over $46 billion in new

auto investments

Other Investments

Magna

Goodyear

ArcelorMittal Dofasco

Ford

General Motors

Umicore

Stellantis

NextStar Energy Inc.

Volkswagen

Honda

A new wave of vehicles

Ontario has seen massive proposed investments by industry leaders in the EV sector.

Over $46 billion in new auto investments

Other Investments

State-of-the-art R&D facilities

Manufacturers and assemblers can partner with Ontario Research & Development Institutions developing cutting edge innovations in the auto sector.

Testing with wind

The Automotive Centre of Excellence at the University of Ontario Institute of Technology is one of the largest and most sophisticated climatic wind tunnels on the planet, where test winds reach speeds of 300 kilometres per hour, temperatures range from -40 to +60°C, and relative humidity ranges from 5-95%.

Metals and Materials

Canmet MATERIALS lab in Hamilton, along with its lab in Calgary, is the largest research centre in Canada dedicated to metals and materials fabrication, processing and evaluation.

The Fraunhofer Project Centre for Composites Research (FPC) is a joint venture between Western University and the Fraunhofer Institute of Chemical Technology (ICT) in Pfinztal, Germany. The FPC at Western develops, tests, validates and characterizes new lightweight materials and advanced manufacturing processes at an industrial scale.

Sensing and Communication

The Waterloo Centre for Intelligent Antenna and Radio Systems (CIARS) provides researchers with five interconnected indoor labs, an outdoor lab and a highly advanced computational facility dedicated to electromagnetic devices and communication and sensing system development and characterization.

Magna’s roots in Ontario run deep, and we are excited about opening a new facility dedicated to a strategic electrification product. The Brampton facility, coupled with investment and growth in five existing [regional] Ontario facilities, allows Magna to keep up with customer demands across several product areas. We are excited to bring new business, more investment and additional jobs to Ontario.

Eric Wilds

CHIEF SALES AND MARKETING OFFICER MAGNA

In good company

The Tokyo-based multinational chemicals company is investing approximately $1.6 billion in constructing the facility. With growth anticipated in the North American EV market, Asahi Kasei expects to make additional multi-billion-dollar investments through multiple phases.

Goodyear Canada Inc. is expanding the company’s facility in Napanee, Ontario to produce Original Equipment (OE) and replacement EV and all-terrain tires.

Dana Canada Corporation's investment will create 105 jobs in Cambridge and Oakville and grow their manufacturing capacity.

LG Energy Solutions and Stellantis

LG Energy Solution (LGES) and Stellantis invest more than $5 billion in a joint venture to build an EV battery manufacturing facility in Windsor.

Magna, one of the world's largest suppliers in the automotive industry, announced today that it will expand its operations across six locations in Ontario with a $471 million investment, expected to create more than 1,000 new jobs by 2027.

Mitsui High-tec (Canada), Inc. announced its plans for a significant $102.3 million investment in Brantford, Ontario. This new facility spanning approximately 103,500 square feet.

Umicore plans to make a $1.5 billion CAD investment to build a first of its kind industrial scale cathode and precursor materials manufacturing plant, in eastern Ontario, Canada.

Volkswagen, Europe's largest automaker, announced that its subsidiary PowerCo will establish an electric vehicle (EV) battery manufacturing facility in St. Thomas, Ontario, Canada.

Be part of Ontario’s automotive future

Ontario has been a great place for Mitsui High-tec (Canada), Inc. to settle and build. With the growing focus on the hybrid and EV industry in Canada, and our opportunity to strengthen the supply chain, Ontario is a fantastic location to be close to borders for export, with space and opportunity to continue growing.

Yasushi Harada

President of Mitsui High- tec (Canada), Inc.

Ontario’s assets in action

Invest Ontario is supporting Minth Group’s nearly $300 million investment to build a new auto parts manufacturing facility in Windsor, Ontario, creating 1,099 jobs.

Siemens Canada invests $150 million to establish a global battery production R&D centre in Oakville, Ontario, creating up to 90 jobs.

Invest Ontario is supporting Linamar Corporation’s more than $1 billion investment in Ontario to develop cutting-edge powertrain components and green automotive technologies, creating more than 2,300 jobs.

Asahi Kasei breaks ground on Canada’s first EV battery separator plant in Port Colborne, Ontario

Watch this behind-the-scenes case study of Asahi Kasei building Canada’s first EV battery separator plant in Port Colborne, Ontario.

Invest Ontario is supporting Hanon Systems’ $155 million investment in Woodbridge, Ontario to produce cutting-edge e-compressors for EVs

Invest Ontario is supporting Jungbunzlauer’s $200 million expansion in Port Colborne, Ontario to build Canada’s first xanthan gum manufacturing facility.

Invest Ontario is supporting Goodyear’s more than $575 million expansion in Napanee, Ontario to produce EV and all-terrain tires

Asahi Kasei to build Canada’s first EV battery separator plant in Port Colborne, Ontario

Honda will build an innovative and world-class electric vehicle assembly plant – the first of its kind for Honda Motor Co. Ltd. – as well as a new stand-alone battery manufacturing plant at Honda’s facilities in Alliston, Ontario.

Ontario and Michigan partnering on cross-border transportation technologies. Projects will help people and goods move safely and efficiently across the border by land, air and water.

In his feature article, Minister Fedeli sets out how Ontario is working proactively across industry sectors as forward-looking companies position for long-term growth in an economy shaped by technological disruption and the need for environmental sustainability.

In the first of a two-outlet mini-series, HJ joins the AutoMobil podcast to discuss why the German auto industry should be considering Ontario for future investments.

In the final installment of his two-outlet mini-series, National Public Radio’s HJ Mai reports on Ontario’s transition towards electric vehicles and building on Canada’s automotive legacy.

In an interview with DIE WELT journalist Laurin Meyer, Vic Fedeli, Ontario’s Minister of Economic Development, Job Creation and Trade discusses the province’s plans to become a world-leading green industry site.

Phase 2 of Driving Prosperity plan will grow Ontario’s auto sector and secure new investments in electric vehicles and battery manufacturing

Ontario, Canada, boosting electric vehicle charging availability. Partnership building Electric vehicle chargers at all ONroute locations.

Ontario launches flagship initiative to lead development of EV and smart transportation technologies.

Ontario, Canada, invests in Windsor electric vehicle battery innovation lab. Project will strengthen province as a hub for tomorrow’s EV.

Landmark investment from Honda Canada secures thousands of jobs and moves Ontario one step closer to becoming a North American hub for building the cars of the future

LG Energy Solution and Stellantis investing in Ontario, Canada, for province’s first large-scale EV battery manufacturing plant.

General Motors of Canada’s investment in Oshawa and Ingersoll plants secures Ontario’s place as a North American automotive hub.

Ontario is quickly becoming a leader in developing and building the car of the future by attracting a $3.6 billion investment from Stellantis in the automaker's Windsor and Brampton plants.

The Ontario government has concluded a successful trade mission to India to strengthen relationships with economic partners and attract new investments in key sectors.

With support from the province, GM Canada has transformed its CAMI manufacturing plant into an all-EV manufacturing facility, the first of its kind in Canada.

Project Arrow makes use of Ontario’s complete end-to-end automotive supply chain and demonstrates the province's world-class automotive capabilities and innovation on the global stage.

Invest Ontario is supporting Magna's $471 million expansion across six different locations in Ontario, expected to create more than 1,000 new jobs by 2027.

Earlier today, Volkswagen, Europe’s largest automaker, announced that its subsidiary PowerCo will establish an EV battery manufacturing facility in St. Thomas, Ontario, Canada.

The plant, Volkswagen’s largest to date, will create up to 3,000 direct jobs and up to 30,000 indirect jobs. Once complete in 2027, the plant will produce batteries for up to one million electric vehicles per year, bolstering Canada’s domestic battery manufacturing capacity to meet the demand for electric vehicles now and into the future.

Discover Ontario's booming electric vehicles sector with Mitsui High-tec (Canada), Inc.’s transformative $102.3 million investment Brantford Ontario, creating 104 jobs.

Dana Canada Corporation’s investment will create 105 jobs in Cambridge and Oakville and grow their manufacturing capacity.

Invest Ontario. Here to help.