Watch this behind-the-scenes case study of Asahi Kasei building Canada’s first EV battery separator plant in Port Colborne, Ontario.

Advanced Materials and Chemicals

WHERE BIOCHEMICAL BRILLIANCE SPARKS TRANSFORMATION

Ontario’s chemical industry is a global nexus of innovation, skilled expertise, and strategic advantages. Tap into unparalleled opportunities across bio-hybrid chemicals, sustainable construction materials, advanced recycling, and bio-based fuels and chemicals.

Forge the future of advanced materials and chemicals here, in Ontario.

A measurable difference

4/10

top global chemical companies operate in Ontario

$21B+

in shipments

~650

chemical manufacturing establishments

1st

Home to the 1st company in the world to source Marcellus Basin natural gas liquids as ethane cracker feedstock

~60%

of Canada’s grain corn and soybean supply—key feedstock for biochemical and biofuel production

$17.8B

exports of goods and services

Ignite your business potential in Ontario

Ontario’s alchemy: evolving into a bio-hybrid global leader

Ontario is a global trailblazer in bio-hybrid chemicals, steering sustainable solutions that transcend borders. Our chemical industry is shaping and influencing industries worldwide, from aviation to innovative materials production.

Materials industry companies have significant cluster and regional impacts across the province, including Sarnia-Lambton, Hamilton, Sault Ste. Marie, the GTA/Niagara, and Eastern Ontario.

27,900+

chemical manufacturing workers

Ontario’s talent transforms elements into industrial innovation

Ontario's chemical manufacturing excellence relies on a highly-skilled workforce, strategic access to key feedstocks and diversified capabilities in high-nickel content steel, modular construction, and advanced recycling.

Tap into a deep pool of talent with 27,200 skilled chemical workers driving innovation and productivity. Ontario has 27 universities and colleges that award degrees and diplomas in Chemical Engineering, Applied Chemistry and Chemical Process and Production.

Ontario’s supply chain: where chemistry crafts tomorrow’s sustainable solutions

Ontario leads the global chemical supply chain, integrating resources seamlessly and championing sustainability with advanced recycling and bio-based fuels and chemicals.

- Get strategic access to heavy and light crudes, natural gas, and natural gas liquids from North American regions

- Leverage our leadership in advanced recycling of plastics/chemicals, decarbonization efforts, and the production of bio-fuels and bio-chemicals for aviation and industrial use

- Access our world-renowned industrial biotechnology research and commercialization institutes.

In good company

ADVANCED MANUFACTURING IN ACTION

Invest Ontario is supporting Jungbunzlauer’s $200 million expansion in Port Colborne, Ontario to build Canada’s first xanthan gum manufacturing facility.

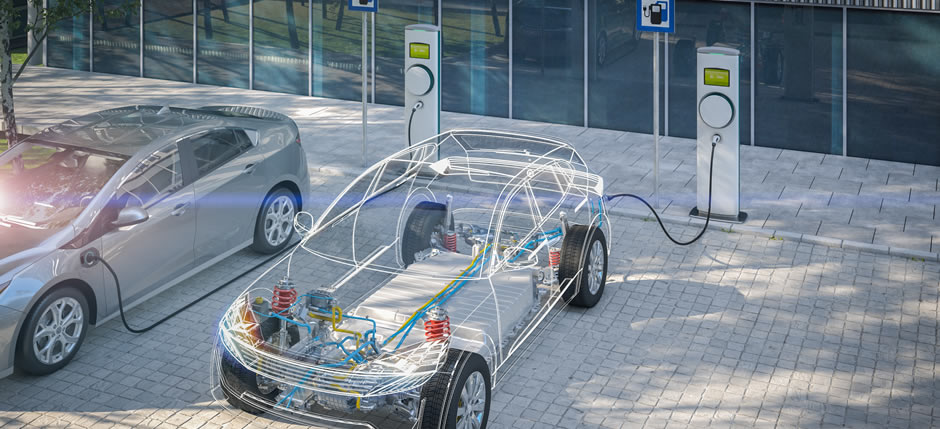

Asahi Kasei to build Canada’s first EV battery separator plant in Port Colborne, Ontario

In an interview with DIE WELT journalist Laurin Meyer, Vic Fedeli, Ontario’s Minister of Economic Development, Job Creation and Trade discusses the province’s plans to become a world-leading green industry site.

In the first of a two-outlet mini-series, HJ joins the AutoMobil podcast to discuss why the German auto industry should be considering Ontario for future investments.

In his feature article, Minister Fedeli sets out how Ontario is working proactively across industry sectors as forward-looking companies position for long-term growth in an economy shaped by technological disruption and the need for environmental sustainability.

Landmark investment from Honda Canada secures thousands of jobs and moves Ontario one step closer to becoming a North American hub for building the cars of the future

Ontario, Canada, invests in clean steelmaking technology to support sustainable auto sector.

Ontario, Canada, invests in Windsor electric vehicle battery innovation lab. Project will strengthen province as a hub for tomorrow’s EV.

LG Energy Solution and Stellantis investing in Ontario, Canada, for province’s first large-scale EV battery manufacturing plant.

The Ontario government has concluded a successful trade mission to India to strengthen relationships with economic partners and attract new investments in key sectors.

General Motors of Canada’s investment in Oshawa and Ingersoll plants secures Ontario’s place as a North American automotive hub.

VueReal investing $40 million to enhance their technology manufacturing capabilities and create 75 new jobs in Ontario. VueReal is one of almost 25,000 tech businesses in the province, contributing over $48 billion annually to the technology sector’s GDP.

Earlier today, Volkswagen, Europe’s largest automaker, announced that its subsidiary PowerCo will establish an EV battery manufacturing facility in St. Thomas, Ontario, Canada.

Invest Ontario is supporting Magna's $471 million expansion across six different locations in Ontario, expected to create more than 1,000 new jobs by 2027.

Dana Canada Corporation’s investment will create 105 jobs in Cambridge and Oakville and grow their manufacturing capacity.

Invest Ontario. Here to help.